tax air freight rules tariff

Thus if you import a container of 1000 of those products you would pay a 1150 tariff. Pursuant to 49 USC.

Iata Air Cargo Tariffs And Rules What You Need To Know

14101 b the parties expressly agree.

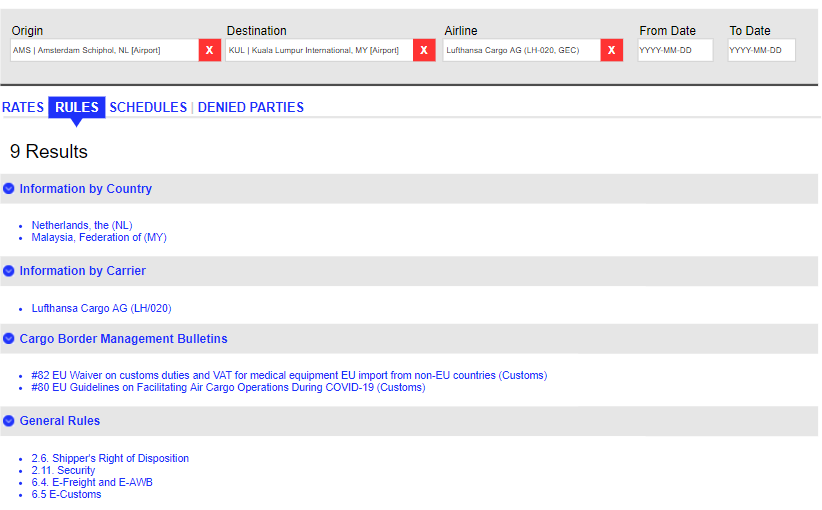

. Whether through the web or integrated with your system our solutions will improve your shipment processing time and free up time so that you can focus on your business. The tariff shall further specify the time period which shall at least allow for the authorized credit period within which. IATAs solutions are fast reliable and very easy to use.

Accordingly no Service Tax could be levied on Ocean freight. Download Rules Tariff PDF Download Selected Accessorial Charges Speed Sheet PDF Download Minimum Charges Item 610 PDF. Where the item is suffixed with a letter the letter A cancels the.

This section also sets forth rules authorized by section 4272b2. This section sets forth rules as to the general applicability of the tax. TACT air cargo solutions are accessible in different formats.

Air freight and air cargo are generally the same. PACIFIC AIR CARGO TARIFF RULES AND REGULATIONS. Normal delivery at final destination at a dock facility designed to receive freight shipments.

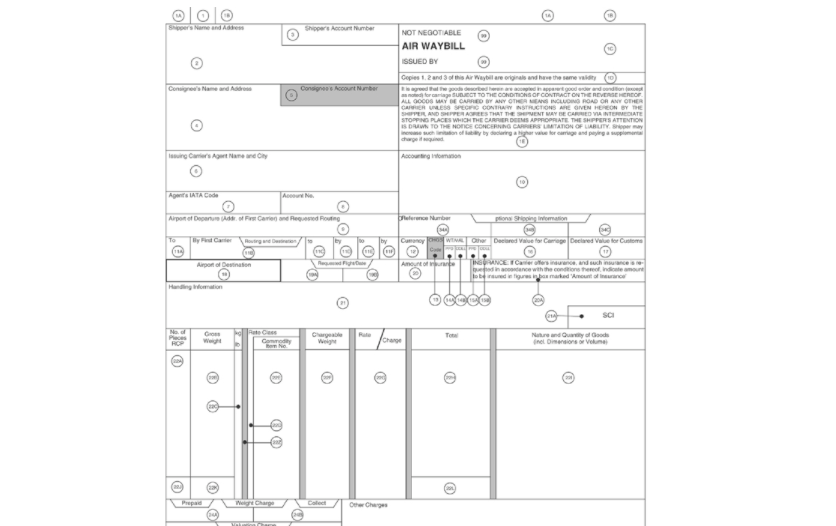

115 application of rules tariff 2 130 application of pricing agreement tariffs 3 135 application of class tariffs 3 140 credit period and late payment charge 4. The Air Cargo Tariff and Rules TACT provides air cargo professionals with the comprehensive information they require to efficiently transport air cargo worldwide. PO Box 070911 Milwaukee WI 53207.

Application of the FedEx Freight 100 Series Rules Tariff. CONTACT OUR TEAM 855 776-3567 Email Customer Service. Specific Tariffs as you may have expected are tariff rates charged as a fixed dollar amount per unit of imported goods.

Compare the solutions now. Different tariffs applied on different products by different countries. Of the unpaid freight bill.

All references in this tariff to Bill of Lading terms published by the National Motor Freight Classification or otherwise refer to the version of the Uniform Straight Bill of Lading as it existed in NMFC 100 Item 365 on August 1 2016 without the modifications made by Supplement 2 to NMF 100-AP issued July 14 2016 by the NMFTA with an. The government may assign a 115 Specific Tariff to a certain product. RL Carriers freight shipping and logistics company.

Service tax air freight Income Tax Goods and services Tax GST Service Tax Central Excise Custom Wealth Tax Foreign Exchange Management FEMA Delhi Value. A freight carrier you can count on. Currently air cargo rates range from.

However costs have risen sharply since February 2020 as a result of severe disruptions in ocean freight and high consumer demand. Tax-Air is a leading provider of logistics and transportation services and has been a trusted partner in the freight forwarding industry for 40 years. UPS Freights Rules and Charges.

Or for accrued lawful charges of air or water carriers as follows. After receipt of goods Transportation or delivery costs incurred after the customer has taken receipt of the goods are not part of the selling price when the dealer is not liable to pay or has not paid the carrier. National sales and local taxes and in some instances customs fees are often charged in addition to the tariff.

Download Adobe Acrobat Reader. Tariff rdfs 100-i roadrunner freight tariff rdfs 100-i naming rules regulations rates and charges for accessorial and terminal services. Tax air freight rules tariff.

The terms and conditions including cargo liability governing transportation services by UPS Freight are set forth in UPS Freights Rules and Charges Tariff UPGF 102. A tariff or duty the words are used interchangeably is a tax levied by governments on the value including freight and insurance of imported products. Different tariffs applied on different products by different countries.

A fee of 35 will be added to the invoice total for each airway bill prepared by Pacific Air Cargo. Rules Table of Contents HERCULES RULES TARIFF HRCF 100 - TABLE OF CONTENTS-----A-----ITEM 125. Unless otherwise provided exceptions to rules of the National Motor Freight Classification herein take precedence over those published in the National Motor Freight Classification.

For most transfers such as airline to airline there will be a minimum fee of 50. All references in this tariff to Bill of Lading terms published by the National Motor. In this instance the amount you pay to the.

If these costs are passed along to the customer they are subject to Retailing BO and retail sales tax when the sale is to a consumer. Section 4271 of the Internal Revenue Code Code imposes a 625 percent tax on amounts paid within or without the United States for the taxable transportation of property as defined in section 4272 of the Code. The Air Cargo Tariff and Rules TACT provides air cargo professionals with the comprehensive information they require to efficiently transport air cargo worldwide.

A Purpose of this section. We are presenting the current less-than-truckload LTL Rules Tariff. Headquartered in Milwaukee WI Tax-Air is a leading provider of logistics and transportation services and has been a trusted partner in the freight forwarding industry for 40 years.

In a typical season international air cargo rates can range from approximately 250-500 per kilogram depending on the type of cargo youre shipping and available space. AF 2 both effective Oct. Tariff-Rate Quota TRQ TRQs involve a two-tiered tariff scheme in which the tariff rate changes depending on the level of imports.

Services include LTL Truckload Logistics Warehousing and more. The ABF Freight Rules and Special Services Charges publication details the rules that govern the provided services and contains the explanation of and charges for optional services that may be requested by the shipper consignee or third-party payer. This rate is not guaranteed if the freight is oversized or requires special handlingequipment.

This tariff is effective from its publication date until the publication date of the next version and individual tariff items may be added deleted or revised during a year shown with a suffix. The Rules set forth in this Tariff apply on all shipments transported by Carrier whether interstate intrastate or international exempt or non-exempt from economic regulation and regardless of origin and destination unless waived by an authorized company official Item 175. UPS Freight Less-than-Truckload LTL transportation services are offered by TFI International Inc its affiliates or divisions.

Tax-Air Terms Conditions for the Regional Carrier Division and the Nationwide Services Division.

How To Read And Understand Your International Airfreight Bill

Service Area Transit Time Tax Air

How To Read And Understand Your International Airfreight Bill

Shipping To And From Canada Yrc Freight Ltl Since 1924

Service Area Transit Time Tax Air

March Industry Update Geodis United States

Service Area Transit Time Tax Air

Freight Forwarder Fees Checklist Protect Your Profits

Service Area Transit Time Tax Air

How To Read And Understand Your International Airfreight Bill

Air Freight Forwarding A Definitive Guide 2021 Freightpaul

Air Freight Forwarding A Definitive Guide 2021 Freightpaul

Freight Shipping Calculator Estimate Freight Rates Cost Fedex

How To Read And Understand Your International Airfreight Bill

Service Area Transit Time Tax Air

Frequently Asked Questions About Air Freight Gocomet

Frequently Asked Questions About Air Freight Gocomet